As the price of passive components continues to rise, MLCC prices remain high. Let's first look at a list of price increases by passive component manufacturers since the third quarter of last year:

From the figure, it can be seen that the prices of MLCC products of major manufacturers, such as Yageo, Fenghua Hi-Tech, Yuyang, TDK, and Huaxin Technology, have increased to varying degrees.

Why is the supply and demand of MLCC so tight and the price soaring?

One, get a general understanding of MLCC

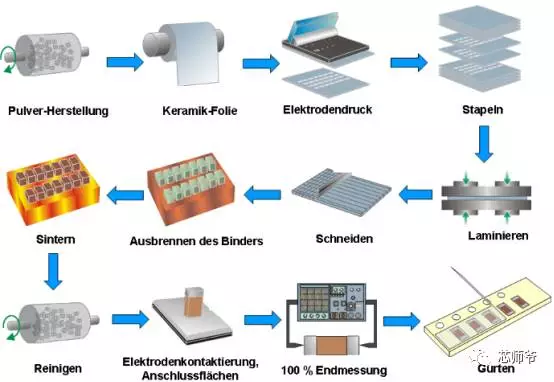

Look at MLCC from the manufacturing process:

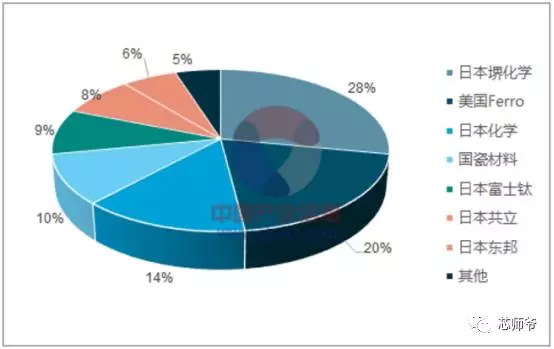

As the core material of MLCC, ceramic powder, what is its market share?

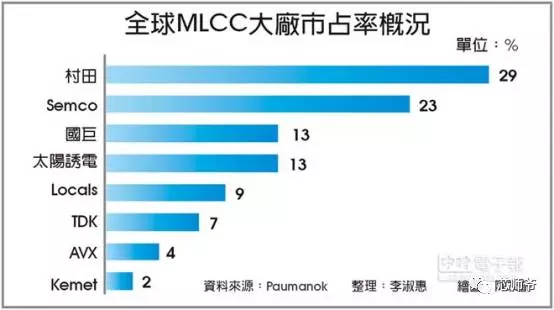

Looking at MLCC from global distribution:

Two. Analyze MLCC from the market structure

According to the changes in market supply and demand, the reasons for the rise of MLCC are analyzed as follows:

1. Demand perspective: upgrade of consumer electronics functions and increase in the amount of new energy vehicles

From a demand perspective, in the field of consumer electronics, passive components represented by MLCC will greatly increase the value of a single machine with the upgrade of consumer electronics product functions and the improvement of communication standards; in the field of automotive electronics, the trend of new energy for automobiles will greatly promote The demand for high-end MLCC products such as medium and high voltage and high capacity has increased.

2. The upgrade of consumer electronics functions and the evolution of communication standards drive the increase in the value of MLCC

Smart phones have entered the era of stock replacement, and product functions have been continuously upgraded, leading to an increase in the use of stand-alone passive components. For example, the fast charging function requires high-quality capacitor technology, and the demand for MLCC products has greatly increased. In addition, with the continuous upgrading of communication standards, it is also expected to lead the increase in the number of MLCCs.

3. From the perspective of supply: production capacity presents a structural shift trend

Regarding the conventional MLCC market, as Taiwan and mainland companies gradually enter the market, the market supply is gradually becoming saturated. Coupled with changes in customer demand, several major international first-line MLCC manufacturers in Japan are adjusting their product directions to miniaturization, RF components and Transfer of high-capacity vehicles and other fields.

Looking at the overall trend, the first-tier MLCC giants have not done much to expand production, and Japanese and Korean manufacturers have hardly expanded their production. In order to adapt to high-end market demand, the main strategy is to shift internal production capacity from conventional products to high-capacity products in the automotive field. High value-added applications such as miniaturized products in the consumer electronics field.

4. Cost perspective: rising raw material costs stimulate MLCC price increases

Take the core raw material ceramic powder as an example. Ceramic powder is the most important raw material for manufacturing ceramic components. Its core requirements are purity, particle size and shape.

High-purity, ultra-fine, high-performance ceramic powder manufacturing technology and technology are the bottleneck restricting the development of my country’s electronic ceramics industry. On the other hand, in the process of preparing ceramic powder, environmental protection requirements have also been paid more and more attention. Japanese manufacturers rely on The leading advantage of ultra-high temperature technology has accounted for more than 70% of the ceramic powder market share. Domestic manufacturers represented by National Ceramic Materials have now mastered the relevant nano-dispersion and coating technology, and currently have a global market share of about 10%.

At present, the ceramic powder market is also in short supply. In the second quarter of this year, China Ceramics announced that the price of ceramic powder products has increased by more than 10%. The price increase of ceramic powder is expected to push the price of downstream MLCC further higher.

After understanding the cause and effect, if you want to stock up, it is very necessary to understand these MLCC original manufacturers and their agents.

First of all, the original MLCC factories mainly include: Guangdong Fenghua High-tech Co., Ltd., Shenzhen Yuyang Technology Development Co., Ltd., Chaozhou Sanhuan (Group) Co., Ltd., Chengdu Hongming Electronics Co., Ltd., Fujian Torch Electronic Technology Co., Ltd., Beijing Yuanliu Hongyuan Electronic Technology Co., Ltd., Dalian Dalikai Co., Ltd., Guangzhou Chuangtian Electronic Technology Co., Ltd., Hangzhou Lingtong Electronics Co., Ltd., Yageo (National Giant), Walsin (Huaxin Technology), Holy Stone (He Shentang) , DARFON, Murata, TDK, Kyocera, TAIYO YUDEN, MARUWA, AVX, SEM (Samsung Electric) Samwha (Sanwa), JOHANSON (Johnson) ATC (American Ceramic Technology Company), Vishay (Vishay)......